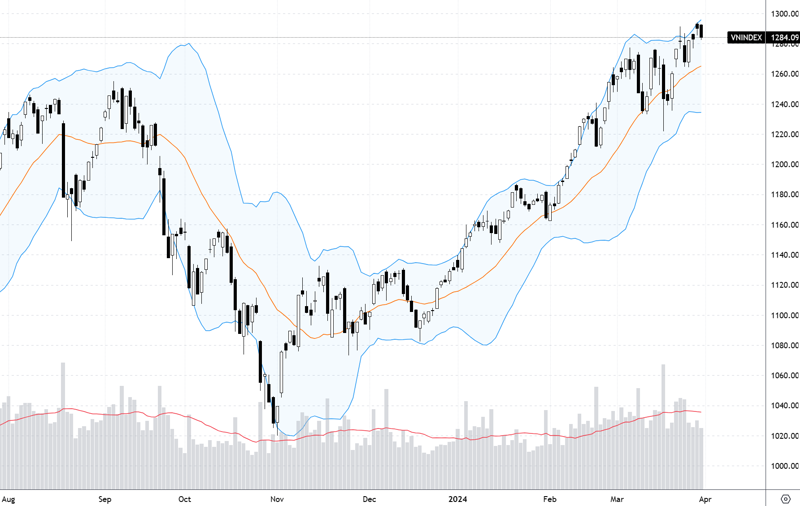

Cash flow trend: Will “beautiful” macro data help VN-Index extend the trend?

" alt="Cash flow trend: Will “beautiful” macro data help VN-Index extend the trend?">

" alt="Cash flow trend: Will “beautiful” macro data help VN-Index extend the trend?"> Last weekend’s trading session received macro data for March and the first quarter of 2024 very early. However, the trading situation fluctuated and then declined, causing opinions to become significantly different…

Last weekend’s trading session received macro data for March and the first quarter of 2024 very early. However, the trading situation fluctuated and then declined, causing opinions to become significantly different.

From a conservative point of view, good information should have good effects in trading. Last week’s session, the market had plenty of time to react because the information was announced early. Therefore, if the information really satisfied the market, it would have increased immediately, but in reality, the market fluctuated gradually.

A more positive view is that the shaking phenomenon in the weekend session is not necessarily due to overlooked fundamental factors, but that investors need time to “absorb”.

More neutral opinions assess that the upward movement still has daily ups and downs and there is nothing unusual. However, the psychological mark of 1,300 points is still a peak when looking back at the uptrend that started in November last year, which has lasted for 5 months. Therefore, whether the VN-Index reaches or exceeds 1,300 points is not the issue, but whether it can continue or not and how far in the short term.